Let’s explore the world of annuities. They remind me of my time in Haiti, where children called every passing vehicle a "machine". To them, whether it was a car, truck, or SUV, it was simply a "machine". Similarly, annuities come in various forms, each serving different financial purposes, much like how vehicles cater to specific transportation needs.

What is an Annuity?

An annuity is a contract with an insurance company. But this definition barely scratches the surface of its versatility. Just as vehicles come in all shapes and sizes, annuities offer different features and benefits tailored to meet various financial goals.

Types of Annuities

- Immediate Annuities: These immediately provide guaranteed income, making them suitable for those needing immediate cash flow.

2. Deferred Annuities: These allow you to delay taxes until later. The next three types of annuities listed are all deferred annuities.

3. Fixed Annuities: These offer a guaranteed rate of return for a specific amount of time. They are like a CD but instead of being held at a bank, they are held at an insurance company. The rates are usually a little higher than CDs and the timeframe a little longer, anywhere from 2-10 years. There are no fees with fixed annuities.

4. Index Annuities: These tie returns to a major index, providing potential for growth while offering protection against market downturns. They were created to beat fixed-rate products over time. There is a cap on how much you can make per year in the index, but also a floor of zero, meaning you will never participate in market downturns. There are no fees with an index annuity unless you add an additional rider.

5. Variable Annuities: These allow investment in mutual-fund-like subaccounts, offering growth potential tied to market performance, but under the umbrella of a tax-deferred annuity. There is a guarantee that the death benefit will at least be equal to your original investment in the even the market (and your account) is down, however, there are also fees for that as well as any other guaranteed benefits. Variable annuities have the highest fees of all annuities.

Each type of annuity serves a unique purpose, much like different vehicles cater to specific transportation needs—from daily commuting to off-road adventures.

Consider Your Options

Understanding the nuances of each annuity type can help you choose one that aligns with your financial objectives. Whether you prioritize stable income, growth potential, or a blend of both, an annuity could play a key role in your portfolio.

Next Steps

In summary, annuities are versatile financial tools that offer a range of benefits depending on your goals and preferences. Like choosing the right vehicle for a journey, selecting the right annuity involves understanding your needs and finding the best fit for your financial roadmap.

For more detailed insights into the various types of annuities, check out this vlog post where we discuss each type in greater detail. You can also read more about Annuities in this whitepaper.

Of course, if you would rather just talk to a real person, just give us a call or reserve a time on our calendar.

One of the fundamental questions in retirement planning is: what’s a safe withdrawal rate?

How much can you withdraw from your retirement savings without running the risk of outliving your money?

It’s a question that draws varied answers and opinions from financial experts.

Understanding Safe Withdrawal Rates in Retirement Planning

For years, Morningstar has published a guideline for a safe withdrawal rate. At one point it was 6%, then slowly dropped and was less than 3% for a while, but has hovered around 4%.

This means withdrawing 4% of your retirement portfolio annually to sustain your income needs.

Sequence of Returns Affects Withdrawal Rates

There have been periods when market downturns have pushed safe withdrawal rates below 3%, highlighting the volatility of relying on fixed percentages. This is a direct result of a sequence of return risk, simply put that is when market losses occur. Losses during the retirement risk zone (highlighted on page 4 of this whitepaper) can change the safe withdrawal percent.

Conversely, there are more optimistic views. I recently spoke with someone advocating for a 10% withdrawal rate based on historical stock market returns. This perspective assumes consistently high returns, which does not align with the unpredictable nature of markets over shorter retirement periods.

So, what’s a realistic safe withdrawal rate?

Much of it hinges on how your retirement accounts are managed.

When managed effectively, a well-structured retirement plan can aim for a sustainable withdrawal rate of around 6%.

This involves careful portfolio management and risk mitigation strategies tailored to retirement needs.

Our Retirement Shift vlog features an interview with our portfolio manager on how we navigate these risks and aim for a stable 6% retirement income.

Of course, if you would rather just talk to a real person, just give us a call or reserve a time on our calendar.

Here’s to securing a prosperous retirement journey!

Instead of viewing it as a rigid budget, let’s reframe it. Think about what you envision for your retirement. What activities do you want to pursue? How will your daily life change from your current routine? These are important considerations when estimating your retirement income needs.

Estimating Your Retirement Income Needs

Start by assessing your current expenses. Identify which of these expenses will continue into retirement—things like housing, utilities, and basic living costs. Then, consider the activities and hobbies you plan to enjoy during retirement. Will you travel more? Pursue new hobbies? These activities come with associated costs that should be factored into your retirement income plan.

Finding Your Comfortable Retirement Income

Determining your comfortable retirement income is a personal journey. It’s about balancing your financial responsibilities with the lifestyle you desire. This process isn’t just about numbers; it’s about aligning your financial plan with your dreams for retirement.

We understand that planning for retirement involves more than just financial calculations. That’s why we’ve developed the Dream Retirement Process. Our book, Creating Your Dream Retirement guides you through identifying what you want from retirement, including how to estimate your retirement income needs without feeling constrained by traditional budgeting methods.

The first step focuses on defining your retirement vision and understanding your financial requirements in a way that resonates with you. It’s about creating a retirement blueprint that reflects your aspirations and ensures your financial security.

Take the First Step

To learn more about our Dream Retirement Process and get started on defining your retirement income needs, download a free copy of our book, Creating Your Dream Retirement.

Also, check out this vlog on the Retirement Shift, this starts you thinking about how to create the retirement income you need.

Here’s to planning for a fulfilling and financially secure retirement!

Securing Your Retirement Income: Planning for Financial Stability

As retirement approaches, one of the most pressing concerns for many is how to ensure a steady stream of income.

After all, during your working years, you receive a regular paycheck—something that provides financial security and stability.

The challenge in retirement is replacing that paycheck to maintain your lifestyle and cover expenses.

Replacing Your Paycheck in Retirement

While Social Security often forms a part of retirement income, it typically isn’t enough on its own.

So, how do you generate the additional income needed to create that retirement paycheck? There are several strategies to consider.

Strategies for Generating Retirement Income

- Systematic Withdrawals: One approach is to withdraw funds from your retirement accounts strategically and consistently. This method allows flexibility but relies on market performance, so it’s not guaranteed. Planning these withdrawals smartly is key to sustaining your income over time. Watch the Retirement Shift to learn more!

2. Guaranteed Retirement Income: For those seeking more certainty, another option is to transform a portion of your savings—such as from a 401(k) or IRA—into a personal pension buy utilizing an annuity that guarantees income just like a pension. If you would like to read more, check out this whitepaper, Annuities as an Asset Class.

Planning for retirement income is a crucial step in ensuring financial stability and enjoying your retirement years to the fullest.

Check out this vlog that dives into more details about the options to create retirement income.

Of course, if you would rather just talk to a real person, just give us a call or reserve a time on our calendar.

Here’s to a secure and fulfilling retirement ahead!

When should I take Social Security? How do I maximize Social security? these are two very common questions we want to help you answer.

Maximizing Your Social Security Benefits: A Strategic Approach

Determining when to take Social Security and how to maximize your benefits are critical decisions for anyone planning their retirement. These questions often go hand in hand, but the answer isn’t always straightforward. Let’s break down some strategies to help you make informed choices about your Social Security benefits.

Timing Is Key

Mathematically, the simplest strategy to maximize your Social Security benefits is to delay taking them as long as possible. Why? Because the longer you delay, the larger your monthly benefit becomes.

However, this approach is not always feasible or even optimal for everyone. The decision on when to take Social Security depends on various factors beyond just maximizing the dollar amount from Social Security to maximizing your entire retirement plan.

Balancing Your Retirement Income

Social Security is typically just one piece of your overall retirement income puzzle. Like driving a car for optimal fuel efficiency, finding the right balance is crucial. You need to consider your other sources of income, expenses, and financial goals. This holistic approach ensures that you maximize not just your Social Security benefits but your entire retirement income strategy.

Planning for Your Future

To explore these strategies in more detail and understand how Social Security fits into your broader retirement plan, check out this vlog post that covers these topics and more. This video dives deeper into how to integrate Social Security into your overall retirement income strategy, providing insights to help you make well-informed decisions.

You can also download this guide on all the ins and outs of Social Security.

Of course, if you would rather just talk to a real person, just give us a call or reserve a time on our calendar. We’re committed to helping you navigate these decisions with confidence. Together, we'll maximize your retirement income and build a stable financial future.

Understanding Financial Planning: Your Business Plan for Life

What exactly is financial planning? It’s a question that often prompts reflection, whether you’re preparing for a speaking engagement or simply pondering your own financial future. To put it simply, financial planning is akin to crafting a business plan—but for your life.

Financial planning involves assessing your current financial situation, identifying your goals for the future, and devising a strategy to achieve them. While this definition often applies to businesses, it’s equally relevant to personal finance.

A Holistic Approach to Financial Planning

At its core, true financial planning is about more than just managing investments or choosing financial products. It’s about ensuring that all aspects of your financial life work together harmoniously. This includes:

- Cash Flow Management: Optimizing your income and expenses to support your financial goals.

- Tax Planning: Strategizing to minimize your tax liabilities and maximize your savings.

- Investment Strategy: Align your investments with your long-term objectives and risk tolerance.

- Estate Preservation: Planning to protect and transfer your assets according to your wishes.

Each of these areas plays a crucial role in your overall financial well-being.

While it’s common to work with different advisors specializing in each area, the key is to integrate these efforts into a cohesive plan that reflects your unique goals and values.

To dive deeper into each of these areas, check out this vlog post.

Planning for Life’s Uncertainties

Financial planning also involves preparing for life’s uncertainties—the unexpected events that can impact your financial stability.

It’s about asking the “what ifs” and having a plan in place to navigate challenges in life.

Moreover, true financial planning goes beyond financial metrics—it’s about defining what truly matters to you!

It’s about aligning your financial resources with your aspirations, ensuring that your wealth serves your life goals, not the other way around. It about having a business plan for life.

Read more in our one-page summary of a Business Plan for Life.

If you have any questions or if you would rather just talk to a real person, give us a call or reserve a time on our calendar.

We’re here to help you navigate your financial journey with confidence.

When Should You Start Saving for Retirement? The Sooner, the Better!

Recently, I was asked a common yet crucial question: when should I start saving for retirement? Whether you’re a parent thinking about your children’s future or a young adult considering your own financial journey, the answer is clear: start as early as possible.

The Power of Starting Early

Mathematically speaking, starting to save for retirement early—even with smaller amounts—can significantly impact your financial future. Those who begin saving in their twenties or thirties, even if they pause at times, often end up with more savings than those who start much later in life. The reason is simple: time is on your side when you start early, allowing your investments to grow through compounding over the years.

Overcoming Life’s Busyness

Life has a way of becoming busy, with endless reasons and excuses not to save. Whether it’s paying off student loans, buying a home, or starting a family, there’s always something demanding your financial attention. However, forming the habit of saving early is crucial. As mentioned in the book The Automatic Millionaire, paying yourself first by saving regularly can lead to long-term financial success.

Where to Start Saving

When it comes to saving for retirement, there are various options to consider:

• 401(k) Plans: If your employer offers a 401(k) and matches your contributions, take full advantage of this benefit—it’s essentially free money.

• Other Investment Tools: Depending on your goals and preferences, you can explore other investment vehicles that offer flexibility, such as IRAs or brokerage accounts and even life insurance designed in the right way, which allows you to save for retirement while still having access to funds for other financial goals, like buying a home.

Tailoring Your Financial Plan

Financial planning isn’t just about where to invest—it’s about aligning your current situation with your future goals. It involves assessing your finances today and creating a roadmap to achieve your desired financial freedom tomorrow.

Check out this book, The New Rules of Retirement Savings written by a respected colleague specifically for YOU. His full book is available to buy on Amazon and other sources.

If you’re unsure where to begin or want to understand the potential impact of starting to save early versus later, we're here to help. Just give us a call or reserve a time on our calendar.

A Required Minimum Distribution (RMD) is a mandatory withdrawal that must be taken from traditional retirement accounts, such as IRAs, 401(k)s, 403(b)s, and other similar plans. Previously, RMDs had to start at age 70.5, but recent changes have increased the age to 73, with the possibility of future adjustments.

The RMD amount isn't a fixed percentage but rather depends on life expectancy, calculated to ensure that funds would last until age 120.

It's crucial to take the RMD on time because failing to do so can result in severe penalties—up to 50% of the amount you were supposed to withdraw.

If you turn 73 during the year, you technically have until April of the following year to withdraw, but delaying could mean taking two distributions in one year, which could have tax implications.

RMDs are taxable based on your current income bracket, they are added into your taxable income.

There's an exception if you direct the distribution to a qualified charity, known as a Qualified Charitable Distribution (QCD). This method not only satisfies the RMD requirement but also allows you to avoid the tax on the withdrawn amount. You can learn more about that on this vlog post, or feel free to connect with us with all your IRA and RMD questions!

Sequence of return risk is an important concept to understand as you approach or enter retirement.

Simply put – Sequence of returns is the order in which negative and positive returns happen.

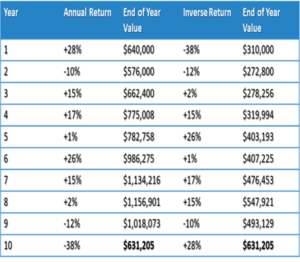

If you’re not taking money out, the order of good and bad years doesn’t matter—you’ll end up with the same total over a period of time not matter what order the returns happen, assuming of course the same returns each year as this chart shows.

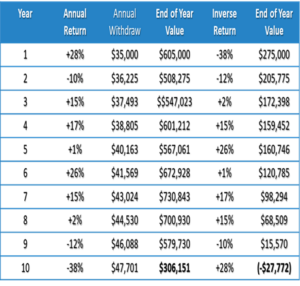

But once you start withdrawals, it’s a different story. If the bad years hit early, your savings can run out much faster compared to starting with good years as this chart illustrates.

This is because losses combined with withdrawals make it harder for your account to recover.

To illustrate further, let’s look at the tale of two sisters retiring at different times.

Sequence of return risk during the lost decade (2000–2010), a period of poor market performance caused many to delay retirement or forced retirees to go back to work, take less income.

While you can’t control market ups and downs, you can take steps to protect your retirement income.

They suggest strategies like the "Colors of Money" to safeguard some assets and the "Retirement Shift" to adjust your plan for this risk.

If you’re concerned about running out of money in retirement, let’s talk! We will set up a plan to minimize sequence of return risk!

This hypothetical example is provided for illustrative purposes only. This chart does not represent specific investment advice provided by our firm or investment results actually achieved by any portfolio of any client of the advisor or firm. Average return calculated by adding all returns and dividing by the number of years shown. Past performance is not an indication of future performance and is not guaranteed.

This material does not provide a complete description of all product features, benefits and risks. This information should not be used as the sole basis for making financial decisions.

1 Source: finance.yahoo.com – The S&P 500 Index is a stock index that is composed of the 500 largest U.S. publicly traded companies by market capitalization, or the stock price multiplied by the number of shares it has outstanding. They do not pay dividends. This is a 10-year illustration based on the historical performance of the S&P 500®. Please note, it is not possible to invest directly into the S&P 500® Index; this measure is provided solely as a benchmark of overall market performance. Past performance of the S&P 500® is not an indication of future performance and is not guaranteed.

- When can you roll over?

- After leaving an employer or retiring.

- After age 59½ (even if still employed), thanks to the in-service, non-hardship withdrawal rule.

- Why consider a rollover?

- Greater control over your investments, with access to more options beyond the limited choices of employer-sponsored plans.

- Ability to reduce risk as you near retirement by leveraging strategies like "green money" for market protection or risk-adjusted portfolio management.

- Potential for better alignment with your financial goals.

- Things to consider:

- Compare fees between your 401(k) and IRA options.

- Evaluate investment strategies and risk tolerance.

- Ensure it aligns with your overall retirement plan.

- How does it work?

- Open an IRA with a new custodian.

- Process the rollover via paperwork, online forms, or over the phone.

- Funds are typically sent directly to the new custodian or to you in a check (made out to the custodian), neither of which are taxable events.

If you're unsure whether a rollover is right for you, reach out for guidance. We will assist in contacting your 401(k) provider to ask the right questions and evaluate your options.

Retirement accounts are qualified plans, meaning are qualified for special tax treatment and can be broken down in a couple of ways.

- Individual vs. Company-Sponsored Accounts:

- Company-Sponsored: Includes 401(k)s, 403(b)s, 457 plans, profit-sharing plans, deferred compensation plans, and pensions. These are managed by your employer and may include features like matching contributions (free money you should take advantage of!).

- Individual: Includes Traditional IRAs, Roth IRAs, and deferred annuities. These are accounts you set up and manage independently.

- Traditional vs. Roth Accounts:

- Traditional: Taxes are deferred until you withdraw funds in retirement. You pay taxes on the harvest (future withdrawals).

- Roth: Taxes are paid upfront, so withdrawals (including growth) are tax-free later. You pay taxes on the seed (initial contributions).

Most company-sponsored plans are traditional, however many now also offer ROTH options inside the plan.

Key points:

- Withdrawals before age 59½ from any “qualified” plan come with tax penalties, although some exceptions are available for certain situations such as education expenses or hardships.

- Contribution limits and tax rules vary by account type.

- Required minimum distributions (RMDs) for traditional accounts begin at age 73.

If you’re unsure about your options or need help understanding your retirement accounts, reach out for personalized advice.